Pre-opening Comments for Thursday March 27th

U.S. equity index futures were lower this morning. S&P 500 futures were down 2 points at 8:35 AM EDT

S&P 500 futures recovered 7 points following release of second revision of U.S. fourth quarter GDP at 8:30 AM EDT. Consensus was annualized growth at a 2.3% rate. Actual was 2.4%.

U.S. auto stocks moved lower following President Trump’s move of a 25% tariff on finished autos imported into the U.S. General Motors dropped $3.04 to $47.91. Ford dropped $0.54 to $8.95.

Jefferies Financial dropped $2.99 to $57.30 after reporting lower than consensus fiscal first quarter earnings.

Steelcase added $1.25 to $11.85 after reporting higher than consensus fourth quarter results

EquityClock’s Market Outlook for March 27th

Stocks have slipped back to support at Monday’s upside open gap, providing a critical test to the oversold rebound from the mid-March lows. See:

https://equityclock.com/2025/03/26/stock-market-outlook-for-march-27-2025/

Technical Notes

Aerospace & Defense iShares $ITA moved above $159.32 to an all-time high extending an intermediate uptrend.

Take Two Interactive $TTWO a NASDAQ 100 stock moved above $218.75 to an all-time high extending an intermediate uptrend.

Cintas $CTAS a NASDAQ 100 stock moved above $210.15 extending an intermediate uptrend.

O’Reilly Automotive $ORLY a NASDAQ 100 stock moved above $1,389.05 to an all-time high extending in intermediate uptrend.

Trader’s Corner

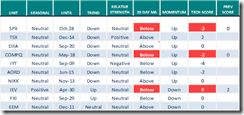

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 26th 2025

Green: Increase from previous day

Red: Decrease from previous day

Source for all positive seasonality ratings: www.EquityClock.com

Commodities

Daily Seasonal/Technical Commodities Trends for March 26th 2025

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for March 26th 2025

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Consumer Confidence Hits The Panic Button & What It Means For Investors

BoC says tariff uncertainty pushed decision to cut rates – YouTube

BMO’s Brian Belski details the path to $6700 for the S&P 500

BMO’s Brian Belski details the path to $6700 for the S&P 500 – YouTube

Canadian Association for Technical Analysis Presentation

Next presentation by ZOOM is by Matt Caruso. Time for the presentation is 7:00 PM EDT tonight. Everyone is welcome. Not a member? See: https://canadianata.ca/

S&P 500 Momentum Barometers

The intermediate term Barometer added 1.60 to 43.40. It remains Neutral. Daily trend is up

The long term Barometer added 0.20 to 49.60. It remains Neutral. Daily trend is up.

TSX Momentum Barometers

The intermediate term Barometer dropped 3.18 to 55.91. It remains Neutral.

The long term Barometer dropped 2.73 to 55.91. It remained Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

|

|

![clip_image001[4] clip_image001[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/03/clip_image0014_thumb-12.png)

![clip_image002[4] clip_image002[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/03/clip_image0024_thumb-13.png)

![clip_image003[4] clip_image003[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/03/clip_image0034_thumb-10.png)

![clip_image004[4] clip_image004[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/03/clip_image0044_thumb-10.png)

March 27th, 2025 at 10:45 am

Tony – AEM is the go to name. I also bought some AGI and hold GLD.