Pre-opening Comments for Tuesday April 15th

U.S. equity index futures were higher this morning. S&P 500 futures were down 20 points at 8:35 AM EDT.

The Canadian Dollar slipped 0.10 to 71.90 cents following release of Canada’s March Consumer Price Index at 8:30 AM EDT. On a year-over-year basis consensus was a 2.6% increase versus a 2.7% gain in February. Actual was a 2.3% gain

S&P 500 futures added 8 points following release of the April Empire State Manufacturing Survey at 8:30 AM EDT. Consensus was an improvement to -14.80 from -20.00 in March. Actual was -8.1

Rocket Lab advanced $0.74 to $19.87 after announcing participation in U.S and U.K military programs

Citigroup added $0.59 to $63.81 after reporting higher than consensus first quarter earnings.

Boeing dropped $4.88 to $154.40 after China halted receipt of new Boeing aircraft.

Bank of America added $0.78 to $37.45 after reporting higher than consensus first quarter earnings.

EquityClock’s Market Outlook for April 15th

When the semiconductor industry shows an underperforming trend versus the Technology sector, generally, it does not bode well for stocks or the economy. See:

https://equityclock.com/2025/04/14/stock-market-outlook-for-april-15-2025/

Technical Notes

The S&P 500 Index just completed the so called “Death Cross” when its 50 day moving average moved below its 200 day moving average.

General Dynamics $GD an S&P 100 stock moved above $277.71 completing a double bottom pattern.

Trader’s Corner

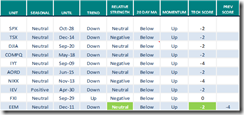

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 14th 2025

Green: Increase from previous day

Red: Decrease from previous day

Source for all positive seasonality ratings: www.EquityClock.com

Commodities

Daily Seasonal/Technical Commodities Trends for April 14th 2025

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for April 14th 2025

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Fundstrat’s Tom Lee: Good stock opportunities emerging despite market zigzags

https://www.youtube.com/watch?v=6DwrFrnfaiY

Morgan Stanley’s Mike Wilson: Investors have seen the worst of the momentum

https://www.youtube.com/watch?v=wB-OK5DXslQ

Trump’s Smartphone Tariff Exemption Boosts Tech: Guy Adami and Dan Nathan

https://www.youtube.com/watch?v=oKqsqmCXqTs

Weekly Update with Larry Berman – April 12, 2025

https://www.youtube.com/watch?v=peDGyMSxUjA&t=317s

How time of day can impact market returns

How time of day can impact market returns – YouTube

CHART THIS with David Keller, CMT Monday 4/14/25

https://www.youtube.com/watch?v=XeaKVq8kHc4

S&P 500 Momentum Barometers

The intermediate term Barometer added another 6.20 to 26.60. It remains Oversold. Daily uptrend was extended.

The long term Barometer added another 3.00 to 31.80. It remains Oversold. Daily uptrend was extended.

Short term (20 days) Barometer jumped another 9.60 to 30.40

TSX Momentum Barometers

The intermediate term Barometer added another 5.05 to 34.40. It remains Oversold. Daily uptrend was extended.

The long term Barometer added another 4.13 to 40.83. It changed from Oversold to Neutral on a move above 40.00. Daily uptrend was extended.

Short term (20 days) Barometer jumped another 11.47 to 33.49.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

|

|

![clip_image001[4] clip_image001[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/04/clip_image0014_thumb-4.png)

![clip_image002[4] clip_image002[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/04/clip_image0024_thumb-5.png)

![clip_image004[4] clip_image004[4]](https://timingthemarket.ca/techtalk/wp-content/uploads/2025/04/clip_image0044_thumb-4.png)

Equity Clock Publications